ABB Terminates Independent Listing of Robotics Unit

Industrial automation giant ABB has decided to halt its previously planned independent listing of its robotics division. On October 8, ABB announced an agreement to sell the unit to SoftBank Group for $5.375 billion (approximately RMB 383 billion).

This deal still requires regulatory approval and customary closing conditions. ABB expects to complete the transaction by mid-to-late 2026. The sale will generate around $5.3 billion in net cash and approximately $2.4 billion in non-operating pre-tax gains.

Earlier in April 2025, ABB had announced a full spin-off plan for the robotics business, aiming for an independent IPO by the second quarter of 2026.

Strategic Shift: Why ABB Opted for Direct Sale

ABB Chairman Peter Voser explained that the board and executive committee carefully evaluated SoftBank’s proposal. Compared to the original spin-off plan, the offer better reflects the long-term value of the robotics division and provides immediate returns to shareholders.

CEO Morten Wierod emphasized that although ABB initially planned to spin off the robotics business, the SoftBank deal secures instant liquidity. ABB intends to use these funds to invest in electrification, automation technology, and potentially finance future acquisitions.

Industry analysts have highlighted that this transaction represents a premium sale. Previously, a spin-off IPO would have valued the robotics unit slightly below $4 billion.

ABB Robotics Performance and Market Position

ABB operates in four main business segments: Electrical, Motion Control, Process Automation, and Robotics & Discrete Automation. The robotics division employs approximately 7,000 people and reported $2.3 billion in sales in 2024, roughly 7% of ABB’s total revenue.

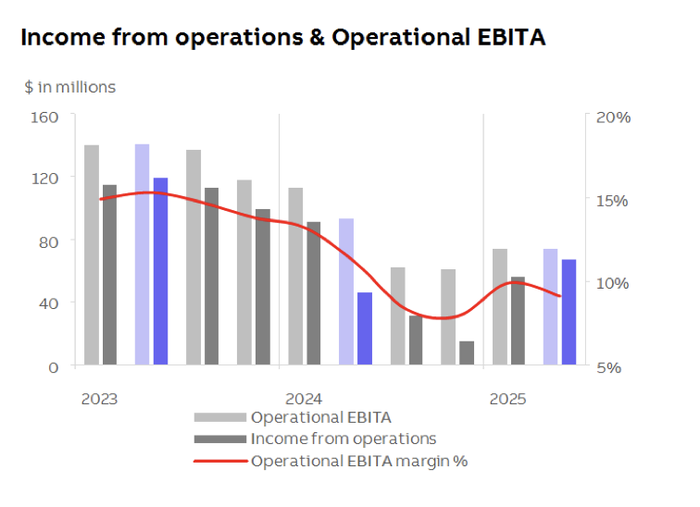

Despite its global reputation, ABB’s robotics unit has struggled to match the profitability of core segments. In 2024, Robotics & Discrete Automation posted an EBITDA margin of 12.1%, while the Electrical division achieved 18.1%. Second-quarter 2025 results showed further pressure on robotics, with EBITDA falling 20% year-over-year to $74 million, translating into a 9.1% margin.

ABB Robotics ranks second globally in industrial robots, following Fanuc, and competes with Yaskawa and KUKA. However, regional dynamics, especially in China, have affected its performance. Local manufacturers now control 57% of the domestic robotics market.

Organizational Adjustments Following the Sale

ABB will reorganize its structure from four divisions into three. The robotics division will be classified as a non-continuing operation starting Q4 2025. B&R Industrial Automation (formerly part of Robotics & Discrete Automation) will merge with the Process Automation segment.

Sami Atiya, head of Robotics & Discrete Automation, will leave ABB by the end of 2026. ABB emphasizes that SoftBank will provide a suitable environment for the robotics unit and its employees to continue growth.

SoftBank’s Robotics Ambitions

SoftBank, known for the humanoid Pepper robot, is actively investing in AI-driven automation. Its portfolio includes US-based Berkshire Grey and other AI robotics ventures. CEO Masayoshi Son envisions combining physical AI with ABB’s robotics technology, aiming to accelerate the integration of AI and industrial automation.

China’s Robotics Market and Local Impact

China remains ABB’s largest robotics market, with over 90% of locally delivered robots produced in-country. ABB’s Shanghai super-factory is the largest and most automated globally. Despite competition, ABB China grew 8.75% in sales from the prior year, reflecting its operational capabilities and early adoption by local clients.

The overall market is rapidly evolving. According to the IFR World Robotics Report 2025, China accounted for 29.5 million robot installations in 2024, 54% of the global total. Local players are expanding faster than international suppliers, highlighting the need for global firms to adapt.

Author Insights: Strategic Implications

ABB’s sale to SoftBank demonstrates a strategic pivot from portfolio expansion to capital allocation and technology investment. This move may allow ABB to focus on high-margin areas like electrification and control systems (PLC and DCS).

For industrial automation professionals, this emphasizes the importance of balancing global R&D with local market dynamics. Companies operating in China must navigate growing domestic competition while leveraging production and service capabilities.

Application Scenarios

- Factory Automation Upgrade: ABB’s divestment may free capital to invest in next-generation PLCs and DCS systems.

- Robotics Integration: SoftBank’s AI robotics solutions can enhance warehouse automation and logistics.

- Industrial AI Deployment: Combining AI with industrial robots offers opportunities in predictive maintenance and assembly line optimization.